Personalized Marketing Messages Pay Off for Retailers

Personalization/Targeted Ads

March 5, 2013 -- Personalized cross-channel marketing -- fashioning "offers and promotions to consumers across multiple touch points based on their past shopping or browsing experiences" -- seems to increase buyer readiness, engagement, and sales activity, according to the study, Engage Consumers & Increase Buyer Readiness Through Customer-Centric Marketing, by customer-centric marketing provider MyBuys and the e-tailing group, an ecommerce merchandising firm.

Key findings from the study of more than 1,100 online shoppers:

-

40% of respondents agree they buy more from retailers who personalize across all channels.

-

41% buy more from retailers that send them personalized promotional emails.

-

39% said they buy more from retailers that personalize web recommendations.

-

Consumers' awareness about personalized marketing is growing with two-thirds (66%) say the retailers where they shop offer promotions and merchandise tailored to their past purchasing and browsing behaviors.

-

Over half of consumers (54%) surveyed are willing to share information about themselves for more personalized shopping, and thus easily find the products and services most relevant to them.

-

Half (51%) of respondents say they are willing to share data to receive a better online shopping experience.

-

Top drivers of buyer readiness to purchase are finding the right product (67%) at the right price (55%).

-

Top online marketing messages that spur purchases:

-

Promotional email from where consumers shops (57%)

-

Search results showing local product availability (53%)

-

Personalized email from retailers where consumers shop (50%)

-

Search results with links to retail website (47%)

-

Online ads showing products from where consumers shopped (35%).

-

-

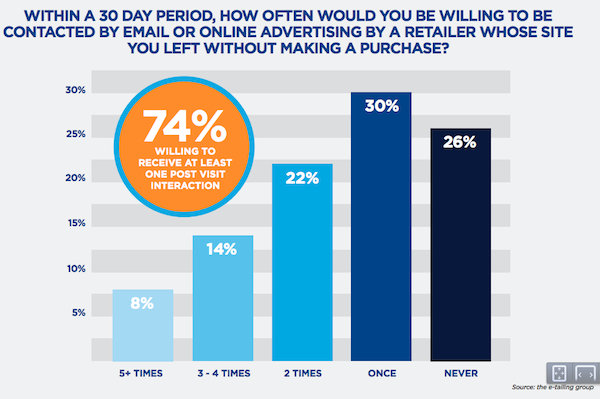

Three out of 4 consumers (74%) report they would be accepting of at least one personal email alert from a retailer after leaving a site without making a purchase.

- The study found when consumers abandon retail sites without making a purchase, it is most often because they were "still in the research process" (44%) or found it "hard to browse for the products" (33%).

- Where do consumers head to after abandoning a retailer’s site? Most often they head to Amazon (60%) and search engines (42%).

About: The study was conducted in December 2012 with 1,108 U.S. consumers completing the online survey. The gender sampling was nearly split (48% female/52% male). Participants had shopped online at least 4 times per year, spent $250 or more online annually and 95% owned a smartphone. Income breakdown: 25%< $50,000, 43% earn $50,000-100,000K, 29%>$100,000.

Source: MyBuy/the e-tailing group, Engage Consumers & Increase Buyer Readiness Through Customer-Centric Marketing, accessed March 8, 2013.