B2B Publishers Say Print Remains Largest Revenue Contributor

B2B

May 2, 2013 -- While some larger B2B publishers have been changing their business models to focus more on digital, events, and data, the majority of the B2B market is retaining a more traditional product and revenue mix and print advertising continues to be their top source of revenue, finds FOLIO: magazine’s latest annual B2B CEO survey.

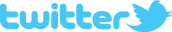

Print Ad Revenue Remains Lion's Share

Print advertising has accounted for about half of B2B publishers’ revenue take for the last four years.

In the 2009 survey, smaller publishers making less than $5 million in annual revenue reported print contributed 54% of revenue; this year the same group reports 55% of revenues were from print in 2012. That is expected to decrease only slightly in 2013, to 53%

Larger publishers making more than $5 million reported print revenues at 53% in 2009 and 48 percent in 2012.

Digital Revenues Climbing

According to this year’s survey, smaller publishers say digital revenues accounted for 15% of revenue in 2012, up 2% from the prior year. Larger publishers reported digital revenues up 3% in one year, to 20% in 2012.

In 2013, smaller and larger publishers expect a slight increase in digital revenues of about two percent each.

Source: FOLIO: 2013 B2B CEO Survey

Custom Publishing Now Referred to as Marketing Services

Marketing services, “one of the hotter sectors in B2B media,” is an updated category this year, the survey states. Prior surveys have included custom publishing as a revenue category; larger publishers saw revenues remain the same while smaller publishers doubled their marketing services revenue from 6% in 2011 (where FOLIO: called it custom publishing) to 12% in 2012.

Fastest Growing Segments

The top three fastest-growing segments for both small and large publishers in 2012 were digital, events, and print advertising.

Among smaller publishers (< $5M), 57% say digital was their fastest growing segment in 2012. Among larger publishers( $5M+), 64% report digital as their fastest growing segment.

More larger publishers (41%) said events were the fastest growing segment; 18% of smaller publishers said events were the fastest growing segment.

More smaller publishers report the fastest growth from print advertising—25% indicated this as their fastest growing sector compared with 19% of larger publishers.

Data and market information sales have “remained at the bottom rung of revenues for years.” Publishers of all sizes report this segment’s revenue share to be in the single-digits. With this said, 32% of larger publishers expect this segment to grow in 2013.

B2B Publishers Are Optimistic

Eighty-five percent of respondents predict their revenues will increase between 2012 and 2013; percent expect it to stay the same, while 3% are forecasting a revenue drop.

Nearly two-thirds (63%) of respondents expect revenues to grow somewhere between 5% and 19% in 2013.

About: The survey sample of 1,000 was selected in systematic fashion by FOLIO: and Readex Research from all of FOLIO:’s domestic subscribers with executive management job titles who classified their company’s primary focus as either b-to-b publishing or a mix of b-to-b and consumer publishing on the FOLIO: subscription form. Data was collected via mail survey from January 30 to March 18, 2013. The survey was closed for tabulation with 193 usable responses—a 19 percent response rate. Results have been filtered to include only those who indicated their organization is involved in b-to-b publishing. The margin of error for percentages based on these 169 responses is +/- 6.9 percent at the 95 percent confidence level.

Source: FOLIO:, 2013 FOLIO: B-to-B CEO Survey, May 2, 2013.