Disconnect: B2B Info Seekers Rely On Print, Yet 1/3 of Publishers Plan Print Ad Cuts

B2B

August 1, 2013 -- According to American Business Media’s “Value of B-to-B” report, B2B information seekers continue to rely on print as a source for industry related content and publishers report that print remains a key source of revenue, nearly a third say they expect to cut their print ad budgets in the next 12 months.

Key findings from the report, which aims to quantifying the role of the B2B information and media industry in the buyer‐seller relationship:

-

Print magazines and websites are the top B2B media for reaching decision makers with industry related content:

Q: How often do you use the following information sources for industry-related content?

Print – 96%

Websites – 96%

Manufacturer product info – 93%

E-newsletters – 92%

Trade Shows – 80%

Print newsletters – 76%

Digital replicas of print newsletters – 69%

Mobile optimized web sites – 56%

Social media – 54%

Mobile apps – 51%

-

B2B users are not making either/or decisions in their use of media. Three-quarters (74%) of respondents say they rely on both digital and traditional media to learn tips/best practices and to gain valuable information they can use in their work.

-

Nearly 7 out of 10 (68%) say they spend more time with industry-related print publications than with mainstream business or consumer print publications.

-

Websites (73%), e-newsletters (67%), and print magazines (45%) are the most common B2B content sources accessed on a weekly basis.

-

Websites (65%), manufacturer product info (62%), and print magazines (48%) are the top 3 resources for decision-makers researching work-related purchases.

-

Nearly all (95%) of B2B media users think that websites will remain important to their jobs, or grow in relevance, over the next five years. The majority (61%) thinks that print magazines will stay constant or grow in importance over the next five years.

-

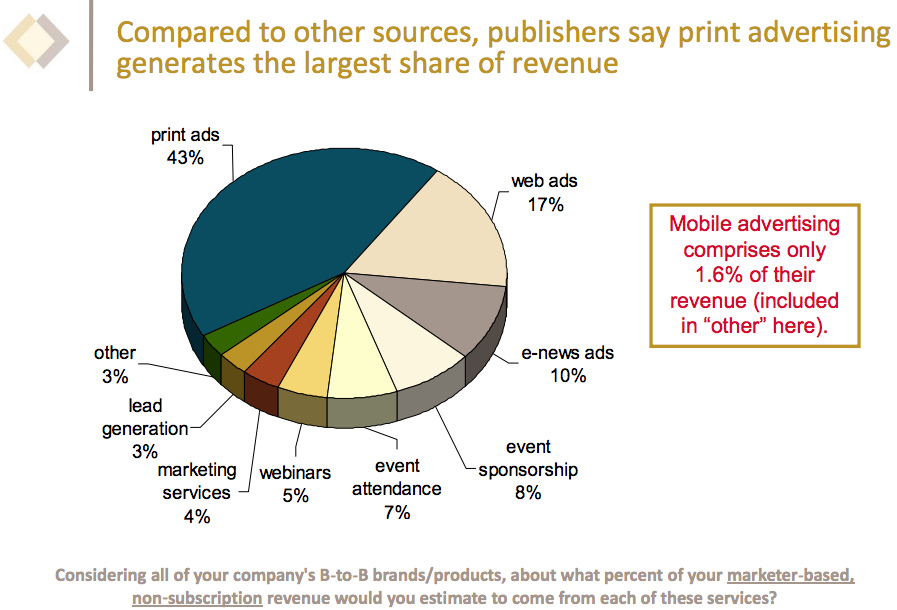

Compared to other information sources, B2B publishers say print advertising generates the largest share of revenue.

Source: ABM, Value of B-to-B, 2013

- While publishers report that print remains a key source of revenue, 32% say they expect to cut their print ad budgets.

- Search engine, mobile, and e-newsletter ads are among the budget areas B2B marketers expect to increase in the next 12 months (45%, 43%, 41% increases respectively).

As stated by ABM “these data points reveal a disconnect between marketers and end-users: marketers are moving away from print media, but our research suggests readers are not, at least not at the pace advertising is leaving print.”

- Nearly 9 in 10 respondents rank trade events as the top tactic for creating awareness and generating leads.

- Many who use smartphone for business would engage with industry content more if publishers:

Offered an optimized version of their website – 75%

Offered a digital version of their magazine at no additional cost – 73%

Enhanced their digital magazines with interactivity (e.g.. video, audio) – 63%

- Media consumers who use mobile devices are more enthusiastic about all forms of B2B media, including print and events, compared with non-mobile users. 87 percent of the heavy mobile group engages with the trade press in print, online, or digitally once per day; only 47% of non-mobiles do so.

About: Three separate surveys were conducted online by Readex Research between March 11 - April 12, 2013). The polls were created by ABM with advisement from research sponsor Adobe Systems, marketer organizations ANA and IBSA, and several partner media companies. Respondents: 6,682 media end-users (readers, event attendees, etc.) responded to the user poll. 111 publishing professionals and 74 marketers responded to the publishing and advertising polls. Results were cross-tabulated in 11 vertical categories, with the most responses in the retail, building construction, utilities, and healthcare verticals.

Sources: ABM, “Value of B-to-B” report and “Value of B-to-B” slideshow, accessed August 7, 2013.