Mobile Now the Main Driver of Global Ad Spend Growth

Ad Projections

December 9, 2013 -- ZenithOptimedia predicts advertising is set to see the strongest sustained period of growth in ten years, with global ad spend growth forecast to rise from 3.6% in 2013 to 5.3% in 2014. Growth is then set to increase to 5.8% in 2015 and 2016. The principle engine of this growth will be mobile technology, which is expanding the space for media consumption.

In the U.S., ad spend has grown 3.3% in 2013, and is forecast to increase4.6% in 2014, boosted by the Winter Olympics and mid-term elections, followed by another year of 4.6% growth in 2015 and 4.1% growth in 2016.

MOBILE IS EXPANDING OVERALL MEDIA CONSUMPTION

- Mobile is now the main driver of global ad spend growth. This the first time in the past 20 years that a new platform is expanding overall media consumption without cannibalizing other media platforms.

- ZenithOptimedia forecasts mobile to contribute 36% of all the extra ad spend between 2013 and 2016.

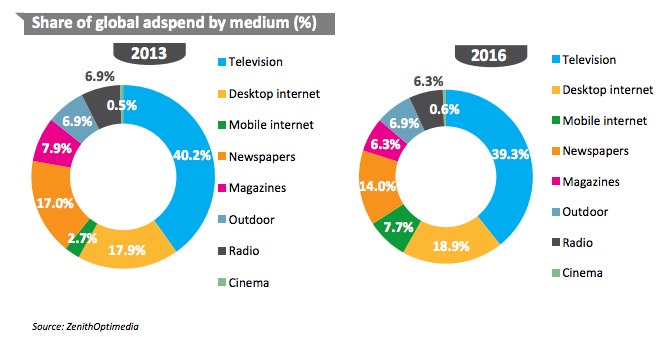

- Despite its sizeable growth, mobile advertising still only accounted for 2.7% of global ad spend in 2013. By 2016, however, it is expected to account for 7.7% of ad spend, surpassing radio, magazines and outdoor to become the world’s fourth-largest medium.

- ZenithOptimedia counts as mobile all internet ads delivered to smartphones and tablets, whatever their format.

GLOBAL AD SPEND BY MEDIUM

Source: ZenithOptimedia, December 2013

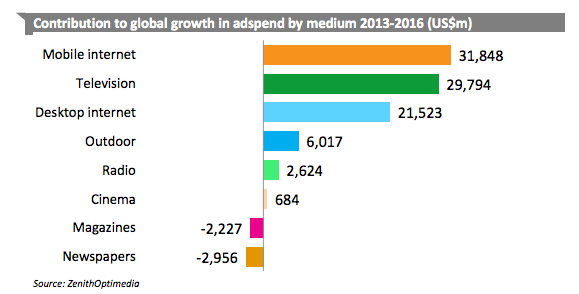

- Behind mobile, television is the second largest contributor (accounting for 34% of new ad expenditure), followed by desktop internet (25%).

- Globally, the internet is still the fastest growing medium. It will have grown 15.8% by the end of 2013, and we forecast an average of 15% annual growth for 2014 to 2016.

- Display advertising is the fastest-growing sub-category, with 19% annual growth, thanks partly to the rapid rise of social media advertising, which is growing at 28% a year.

- Paid search is expected to grow at an average rate of 14% a year to 2016, driven by continued innovation from the search engines, including the display of richer product information and images within ads, better localization of search results, and mobile ad enhancements like click-to-call and geo-targeting.

- Online classified has been subdued since the downturn in 2009, since it depends heavily on the weak property and employment markets in the developed world. ZenithOptimedia forecast average annual growth of just 6% for the rest of the forecast period.

-

Internet advertising has principally risen at the expense of print. Between 2003 and 2013 the internet’s share of global advertising rose by 17 percentage points, while newspapers’ share fell 13 points and magazines’ share fell by 5 points. It is predicted that newspapers and magazines will continue to shrink at an average of 1%-2% a year. (Note: these figures include only advertising in printed editions of these publications, not on their websites, or in tablet editions or mobile apps, all of which are included in the internet category.)

BIGGEST AD DOLLAR CONTRIBUTORS

- Mobile is now the main driver of global ad spend growth and is expected to contribute 36% of all the extra ad spend between 2013 and 2016.

- Television is the second largest contributor, accounting for 34% of new ad expenditure. Television’s share of global ad spend has stabilized, after growing slowly but surely for most of the last three decades.

Source: ZenithOptimedia, December 2013

Source: ZenithOptimedia, Executive Summary: Advertising Expenditure Forecasts December 2013, accessed Dec. 13, 2013.